Why Hack VC Led Babylon's Series A: Our Investment Thesis

By Ed Roman, Co-Founder and Managing Partner at Hack VC

Today we are very proud to see Babylon's network launch. In late 2023, we at Hack VC led Babylon’s Series A financing round, and we’ve been proud supporters of the team since those early days. At the time, BTC was only worth $27K - the depths of a bear market. Since then, the team has worked extraordinarily hard, and the project has evolved to the point where we believe it to be the most important project in the Bitcoin ecosystem (other than BTC itself). The following is our investment thesis in Babylon.

What Is Babylon?

At its core, the simplest way to think about Babylon is it’s a two-sided marketplace.

The supply side of the marketplace are BTC holders looking to earn additional yield in a safe and trustless manner.

The demand side of the marketplace are blockchain protocols who wish to tap into BTC to provide economic security for their network, to prevent sybil attacks and 51% attacks. Babylon refers to these “customers” of economic security as Bitcoin Secured Networks (BSNs).

If you’re up to speed on Eigenlayer (another Hack VC portfolio company), this should sound familiar. A simple way to think about the core of Babylon is: what Eigenlayer is to ETH, Babylon is to BTC. However, Babylon’s vision expands beyond this as well, which we’ll cover in this article.

Babylon As a Form of Collaborative Consumption

Babylon enables BTC to be utilized more efficiently by harnessing it as a form of economic security. This is an example of collaborative consumption. It’s analogous to how Airbnb pioneered renting your apartment/house while out of town. A Web3 analogy would be GPU DePINs, such as io.net (another Hack VC portfolio company) enabling better usage of GPU resources.

Collaborative consumption models are exciting since they bring new economics and efficiencies to industries. In our experience, whenever you provide a service that creates new economics, adoption tends to occur relatively quickly (more on Babylon’s traction numbers below). In Babylon’s case, it’s providing a double layer of new economics: both (a) new yield to BTC holders on the supply side, and (b) cheaper economic security on the demand side than the status quo (i.e., recruiting a set of validators and creating economic incentive for them).

Babylon Genesis: A New Layer 1

The first Bitcoin Secured Network (BSN) is Babylon Genesis. This is a multi-faceted blockchain created by Babylon, and has the following elements:

- It is a Cosmos-style Layer-1 secured by Bitcoin. It leverages Bitcoin staking and Bitcoin timestamping to harness Bitcoin security.

- It’s a control plane that coordinates the other BSNs with Bitcoin so that they can efficiently receive Bitcoin security and liquidity with minimal integration efforts.

- It’s a liquidity hub that manages Bitcoin liquidity through on-chain applications that are secured by Babylon Genesis.

- It contains enabling financial primitives such as a DEX, restaking, vaults, LST minting functionality, and bridging functionality for those BTC LST holders. This empowers users to participate in BTC-enabled DeFi (i.e., “BTCFi”) while enjoying the security of Genesis being secured by Bitcoin.

Longer term, Babylon Genesis is expected to evolve to include additional financial primitives, such as BTC-based lending protocols, incentive markets, and more. This positions Babylon in a similar conversation to other financially aligned Layer-1s and expands the vision tremendously.

The Importance of Trustlessness

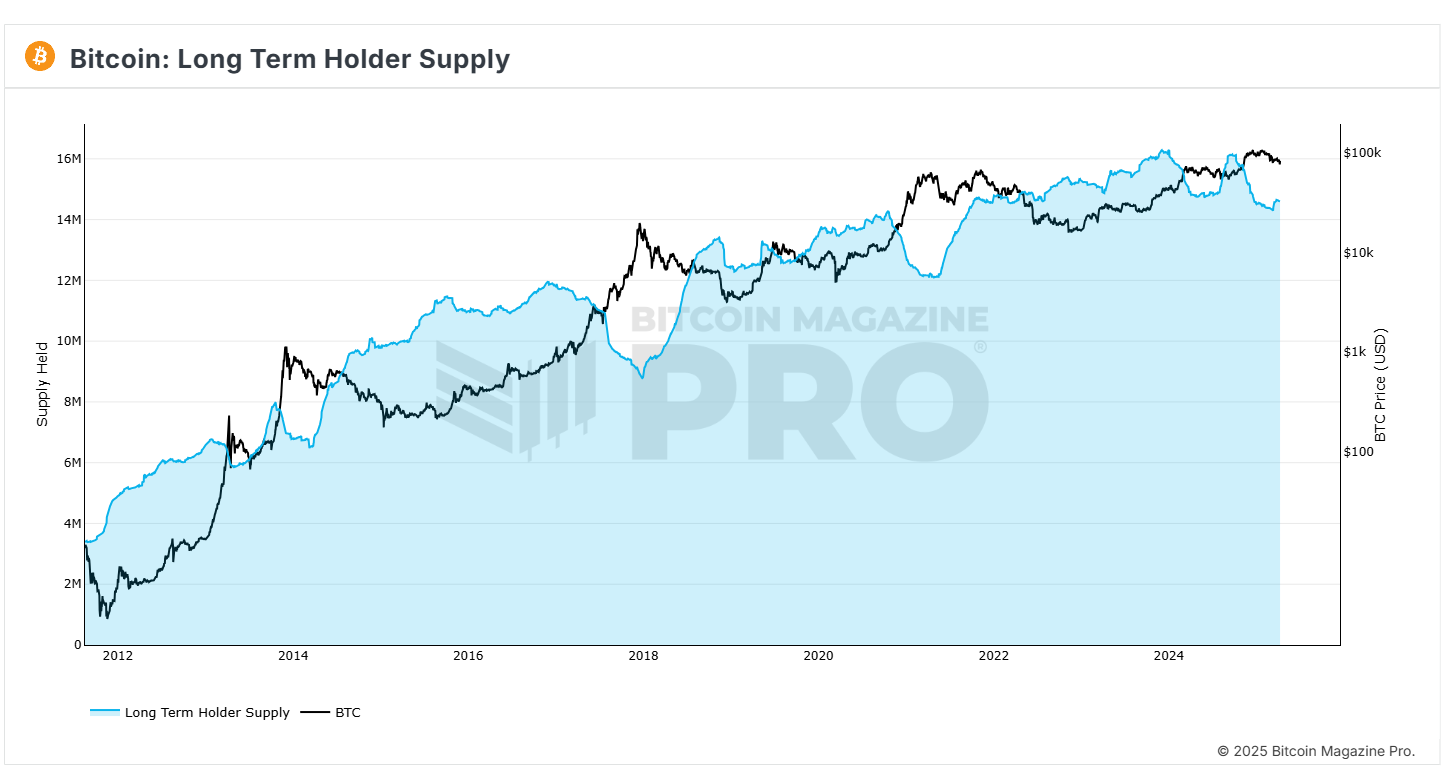

One potential challenge when considering BTC staking is trust. BTC holders are reputable for being conservative in their risk tolerance. Most BTC owners HODL for as long as possible and are not interested in selling their BTC due to the asset being a store of value. But that can result in a large percentage of one’s finances tied up in the asset. Many BTC holders would love to earn short-term yield that’s spendable while still remaining long BTC.

The challenge with earning yield on BTC is safety and security. For example, it’s unreasonable to expect BTC holders to transfer their BTC to a third party wallet to be used as collateral when earning yield. Sophisticated BTC holders generally avoid bridging assets across chains outside of Bitcoin, since they know that bridge hacks are common due to bridging pools being honeypots for inviting attackers. Most bridges are secured by multi-signature wallets, which can be compromised. Trusting your BTC to a centralized service is also an unwelcome risk, as we saw with the collapse of BlockFi, Celsius, and Three Arrows Capital.

What Babylon brings to the table is a refreshing way to earn yield on BTC that is trustless. You don’t need to transfer your BTC to another wallet. There’s no bridging with multi-sigs involved. And you certainly don’t need to trust a centralized player. This key unlock brings yield to BTC holders while also providing safety in a self-custodial manner. Babylon accomplishes this via Bitcoin staking (which uses Bitcoin timestamping, a primitive that was invented by the co-founder of the Babylon protocol, David Tse).

Contagion Risk and Staking vs. Re-Staking

In our diligence for Babylon, we spoke to a number of customers that were considering using Babylon so that we could better understand their needs. A pattern emerged, which is that some customers were concerned about contagion risk from re-staking.

To understand contagion risk, consider Ethereum. A significant amount of ETH is already staked (e.g., via Lido staked ETH). If you then re-hypothecate that asset to secure multiple networks, you are effectively re-using that security across multiple customers. That is highly capital efficient and results in the lowest possible costs of capital for economic security because the burden of “paying” for that economic security is shared among customer networks. However, there is a drawback to this approach as well: contagion risk. If one re-staked service has their economic security slashed, then that could put the other networks at risk as well who rely on that same economic security.

Note that this is hypothetical and hasn’t yet occurred, so the actual chances of such an incident occurring are undefined. However, there was a class of customers in our diligence that were not willing to take that perceived risk.

Babylon’s value proposition solves this concern because of the underlying asset itself: BTC. BTC is not “staked” anywhere right now because it’s a Proof of Work asset. But with Babylon, BTC holders can now stake their BTC for the very first time. Since BTC isn’t staked anywhere yet, there is no potential for contagion risk. We are merely exploring staking BTC for the very first time and for a single customer. Therefore, no chain reaction of contagion risk can occur. In fact, initially the staked BTC through Babylon is used to secure a single BSN (Babylon Genesis, the first BSN discussed earlier in this article).

Note that hypothetically, this is not as capital efficient as re-staking, since assets are gaining “less re-use” by having them secure a single customer at a time. Due to this, the Babylon ecosystem also plans to support re-staking in the future, so that customers who are comfortable with assuming some contagion risk can gain economic security at lower yields due to the shared economic model.

Traction

Babylon is off to an incredible start and has over $3.7B in BTC already pledged to stake, representing over 49,000 BTC. This capacity is provided by over 135,000 stakers. You can see the latest numbers here: https://btcstaking.babylonlabs.io/.

Learn More

If you are interested in diving deeper into Babylon’s technical architecture, take a look at a whiteboarding session that our Research Partner Shane Barratt conducted with David Tse, the co-founder of the Babylon protocol, here: https://www.youtube.com/watch?v=ws5uUlQ6X30. We call these “Gigabrain Sessions” for those who are curious to get a deeper technical cut.

Conclusion

We hope you enjoyed learning about our thesis in Babylon. The team has surpassed expectations, and we’re proud long-term lead investors in the project. We are particularly excited about BTC as a form of economic security because it represents the largest market size of all crypto tokens. As of the time of this writing, BTC has $1.6 trillion dollars of market capitalization. With Babylon Genesis as a true Layer-1, Babylon aims to enable a thriving ecosystem that leverages this economic security. This means Babylon can hypothetically have the largest potential outcome out of all the staking and re-staking providers in Web3.

Disclaimer

The information herein is for general information purposes only and does not, and is not intended to, constitute investment advice and should not be used in the evaluation of any investment decision. Such information should not be relied upon for accounting, legal, tax, business, investment, or other relevant advice. You should consult your own advisers, including your own counsel, for accounting, legal, tax, business, investment, or other relevant advice, including with respect to anything discussed herein.

This post reflects the current opinions of the author(s) and is not made on behalf of Hack VC or its affiliates, including any funds managed by Hack VC, and does not necessarily reflect the opinions of Hack VC, its affiliates, including its general partner affiliates, or any other individuals associated with Hack VC. Certain information contained herein has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, neither Hack VC, its affiliates, including its general partner affiliates, or any other individuals associated with Hack VC are making representations as to their accuracy or completeness, and they should not be relied on as such or be the basis for an accounting, legal, tax, business, investment, or other decision. The information herein does not purport to be complete and is subject to change and Hack VC does not have any obligation to update such information or make any notification if such information becomes inaccurate.

Past performance is not necessarily indicative of future results. Any forward-looking statements made herein are based on certain assumptions and analyses made by the author(s) in light of their experience and perception of historical trends, current conditions, and expected future developments, as well as other factors they believe are appropriate under the circumstances. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict.