Hack VC 2025 Wrapped

We went into 2025 with high expectations, both for our firm and the broader industry. In our 2024 Wrapped post, we wrote that we believed 2025 would be remembered as the year the crypto industry truly turned a corner. “A year when foundational investments, thoughtful regulation, and technological convergence began shaping the future of a decentralized, interconnected global economy.”

Looking back now, that call feels pretty close to the mark with the passage of the GENIUS Act and the progressively blurred line between Web2 and Web3, particularly in financial services.

This post is a look back at what happened in 2025 for Hack VC – we’ll share what we invested in and what those investments turned into over the course of the year. We’ll also cover the communities we brought together, what we learned, and ideas we published. Finally, we’ll detail what we believe is in store for the Hack VC platform in 2026.

What We Invested In

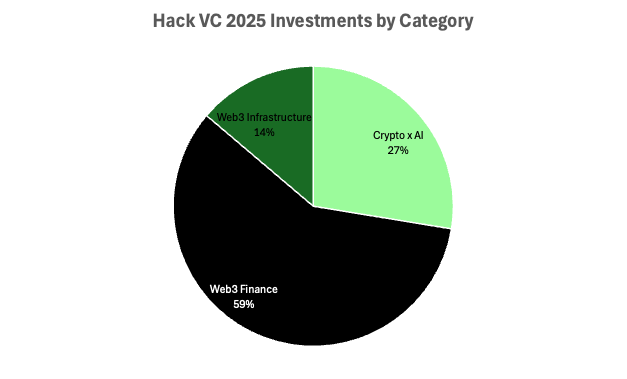

In 2025, we deployed ~$50M across 29 deals, maintaining a pace that allowed us to stay deeply involved with founders while still being selective about where we spent our time and conviction. Our focus remained tight and thesis-driven, centered on three core areas where we believe crypto has the ability to both push the technical frontier and create meaningful economics:

- Crypto x AI

- Web3 Finance

- Web3 Infrastructure

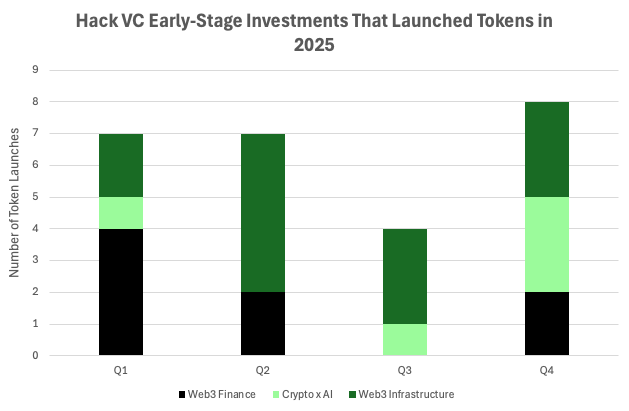

Last year, 26 of our portfolio companies launched public tokens, and ~70% of those launches occurred on major global exchanges like Binance, Bybit, OKX, Bitget, and Coinbase.

A few token launches stood out:

- Stable ($2B*): We led the seed round of Stable, a Layer-1 blockchain purpose-built for stablecoins, incubated by Tether and advised by Tether CEO Paolo Ardoino. We invested alongside a group of strategic and institutional partners that included PayPal, Franklin Templeton, Susquehanna Group, and many of the largest centralized exchanges in crypto. Read our investment thesis here.

- 0G ($1B*): We were the first and largest investor in 0G, leading both the pre-seed and seed rounds. 0G is a Layer-1 designed specifically for crypto AI applications. Read our investment thesis here.

Rail: In addition to token launches, one of our earliest investments reached a major milestone. Rail, a global payments infrastructure company, was acquired by Ripple for $200M. We led Rail’s pre-seed round in 2021 and participated in multiple follow-on financings along the way.

We were able to distribute capital back to our investors across multiple vintages, just 4 years after Hack VC was founded.

Bringing the Community Together

One of Hack VC’s defining strengths has always been community building, particularly among developers and technical founders.

Our hack.summit() developer conference series is a good example. To date, hack.summit() has attracted more than 130,000 attendees from 157 countries. In 2025, we hosted hack.summit(“Seoul”) on September 22 at the Josun Palace, just ahead of Korean Blockchain Week, bringing together founders, builders, investors, and researchers for a full day of deep technical conversation.

We also hosted what we believe was our best Investor Day yet! The theme was simple: a thesis-driven AGM for a thesis-driven firm. We brought our investment theses to life through conversations with founders, policymakers, and industry leaders shaping crypto’s next decade.

Highlights included fireside chats with Brad Garlinghouse of Ripple on global payments, Bo Hines on U.S. crypto policy and competitiveness, and leaders from Fidelity, S&P Global, and Ant Group on institutional adoption. Check out clips and highlights here.

Beyond that, we hosted more founder dinners and small gatherings than we can count. If you joined us at any point last year, thank you for being part of the community.

What We Learned and Published

We spent a meaningful amount of time last year writing, recording, and sharing what we are learning as investors and builders.

In 2025, we published:

📃13 investment theses

🔎6 long-form research articles

📽️10 Gigabrain Sessions (in-depth conversations with our portfolio founders)

🎤4 podcasts

A few of our most popular pieces of content:

- Ambient and Abundant: Intelligence Beyond the Scaling Era: Our CTO and Partner Harrison Dahme laid out our latest thinking on Crypto x AI. He shares a clear take on what comes after the scaling era of AI, and where durable value actually accrues when intelligence becomes cheap.

- Unchained Podcast: Two VCs on Why the 4-Year Cycle Is Dead, DATs & Hyperliquid vs. Binance: Partner Peter Hans joined Unchained to discuss one of crypto’s biggest 2025 phenomena – DATs – as well as stablecoins and what it actually means for crypto markets to mature.

- Crypto’s Killer App: The US Dollar: Peter also published an article in wealthmanagement.com explaining why stablecoins have become crypto’s most powerful use case, while simultaneously reinforcing U.S. dollar dominance on a global scale.

Growing the Firm

We closed additional capital last year, including our second seed fund. Hack VC had ~$550M in committed capital as of year-end and ~$700M in AUM as of Q3.

We also continued to grow the team in a deliberate way:

- Harrison Dahme joined as CTO and Partner, bringing experience as the former CTO of a leading Crypto x AI company, a crypto advisor to Lightspeed Venture Partners, and a founder whose prior company exited to Coinbase. Read this blog post to hear from Harrison on why he joined us.

- Kazi Ahmed joined as Accounting Manager, bringing more than a decade of experience across asset management, fintech, and financial services.

Looking Ahead to 2026

Hack VC is, and always has been, a thesis-driven firm, and that mindset continues to guide how we spend our time, our capital, and our attention.

Looking ahead, we see two major forces shaping the next chapter of crypto:

First, we are continuing to push the technical frontier of the industry. That includes AI, quantum-resistant systems, robotics, and privacy-preserving infrastructure. This requires research, staying close to the developers and academics who sit at the edge of what is possible, and building enough internal technical fluency to recognize real breakthroughs when they appear.

Second, the convergence of crypto and traditional finance will continue, particularly in stablecoins and real world assets, which are already absorbing entire categories especially within fintech, payments, and banking. Some of this will look like normalization, but we believe the weird, ambitious, and occasionally uncomfortable ideas that make this industry special are not going away.

We are excited for what comes next, and grateful to everyone building alongside us. If you are a founder building in any of these areas, or an individual or institution interested in participating in the next wave of Web3 growth, we would love to hear from you! Reach out to contact@hack.vc.

*$2B is Stable’s fully diluted market cap as of January 2026. $1B is 0G’s fully diluted market cap as of January 2026.

Disclaimer

The information herein is for general information purposes only and does not, and is not intended to, constitute investment advice and should not be used in the evaluation of any investment decision. Such information should not be relied upon for accounting, legal, tax, business, investment, or other relevant advice. You should consult your own advisers, including your own counsel, for accounting, legal, tax, business, investment, or other relevant advice, including with respect to anything discussed herein.

This post reflects the current opinions of the author(s) and is not made on behalf of Hack VC or its affiliates, including any funds managed by Hack VC, and does not necessarily reflect the opinions of Hack VC, its affiliates, including its general partner affiliates, or any other individuals associated with Hack VC. Certain information contained herein has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, neither Hack VC, its affiliates, including its general partner affiliates, or any other individuals associated with Hack VC are making representations as to their accuracy or completeness, and they should not be relied on as such or be the basis for an accounting, legal, tax, business, investment, or other decision. The information herein does not purport to be complete and is subject to change and Hack VC does not have any obligation to update such information or make any notification if such information becomes inaccurate.

Past performance is not necessarily indicative of future results. Any forward-looking statements made herein are based on certain assumptions and analyses made by the author(s) in light of their experience and perception of historical trends, current conditions, and expected future developments, as well as other factors they believe are appropriate under the circumstances. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict.