Crypto’s Killer App: the US Dollar

Since I began focusing on crypto in 2016, there have been a handful of shifts in overt US digital asset policy; and the significance of the most recent shift cannot be overstated. The bipartisan passing of the GENIUS Act, signed into law on July 18th, signals a clear 180-degree reversal. The overarching narrative has shifted. Where blockchain was once seen as a tool to help virtual currencies supplant the US dollar, it’s now being recognized as an inevitable technology that can serve to solidify the dollar’s standing as the global reserve currency.

There is a significant benefit to the United States in controlling the global reserve currency. When there is a consistent global bid for US dollars, the cost of capital is cheap and new debt can consistently be issued to help fund domestic growth and entitlements. Regardless of one’s political views on the role that the government should play, controlling the global printing press with a relatively low cost of debt service is unequivocally a good thing. As a result, it’s not a surprise that the US has long focused on protecting this dynamic from external competition, be it sovereign (Renminbi) or decentralized (Bitcoin).

Stablecoins: The Killer Crypto App

While the approval of the Bitcoin ETF in January 2024 served as the catalyst to reverse the previous crypto winter, and the popular institutional TradFi narratives have long focused on tokenization, stablecoins are the true killer application of crypto.

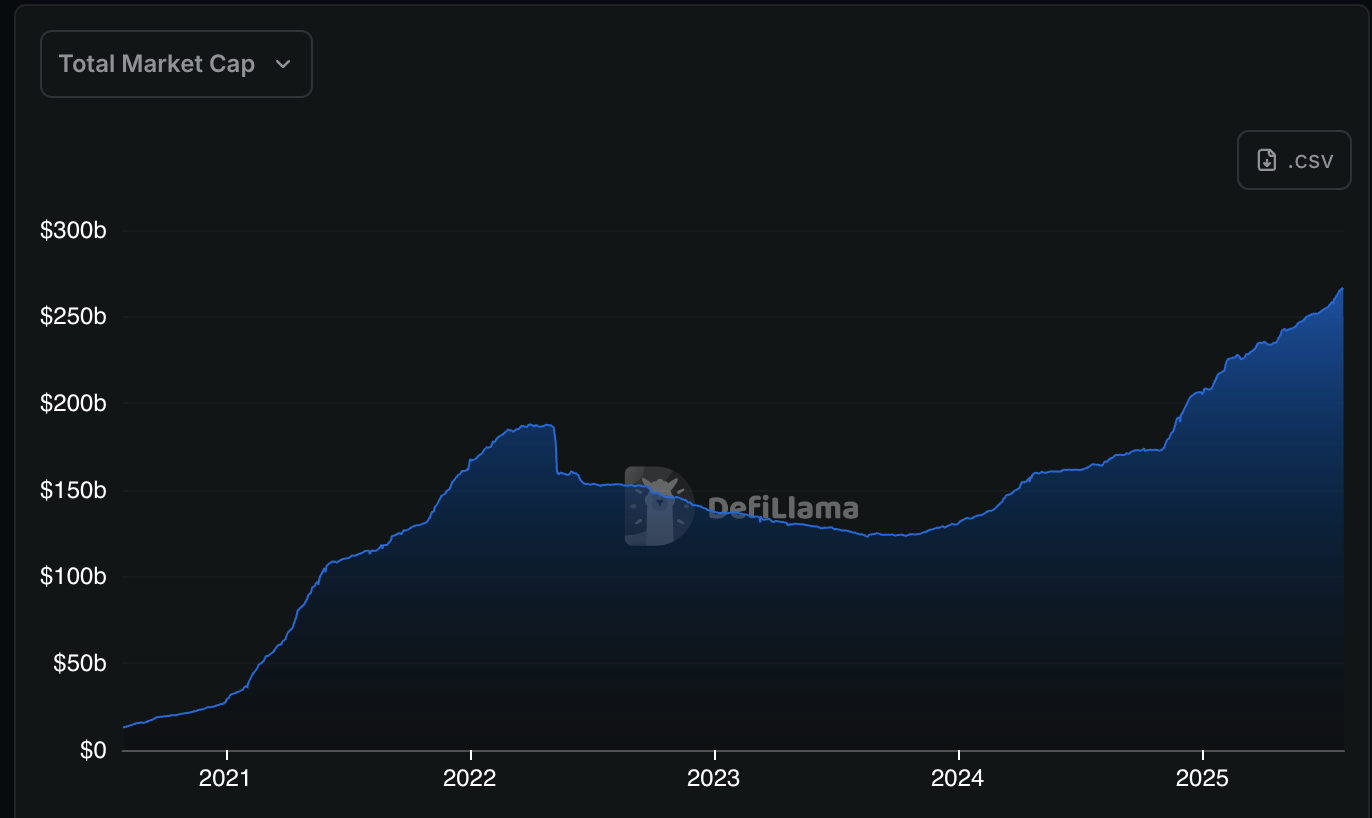

With an aggregate Stablecoin market cap of nearly $267 billion, up from $13.4 billion less than five years ago, the evidence is overwhelming.

As can be seen from the above chart, in addition to the staggering five-year growth, the amount of US dollars settled on-chain has nearly doubled year-over-year. Over 60% of the market is captured by Tether’s USDT, though this market share could continue to compress over time due to competition from current players such as Circle’s USDC, as well as growing participation from traditional financial heavyweights such as Blackrock, PayPal and Franklin Templeton.

Stablecoins: What, How and Why?

Stablecoins have very clearly found product-market-fit, but it might be helpful to take a step back; what are Stablecoins and how do they work? Let’s start with why they were created in the first place.

While blockchain as a settlement layer has a stronger chance than ever to provide the rails of our global financial infrastructure, this was not always the case. Given the friction inherent in the interaction between crypto and our legacy financial framework, stablecoins initially represented a way for crypto market participants to more easily trade, and to derisk without having to exit the ecosystem. Considering everything from Bitcoin to PEPE is quoted in dollar terms, it seems obvious to have a crypto native token that serves as a digital clone of a US dollar. Further, the 24/7 and permissionless transaction dynamics make stablecoins simply a better mouse trap as both a cross-border and as a peer-to-peer payments option.

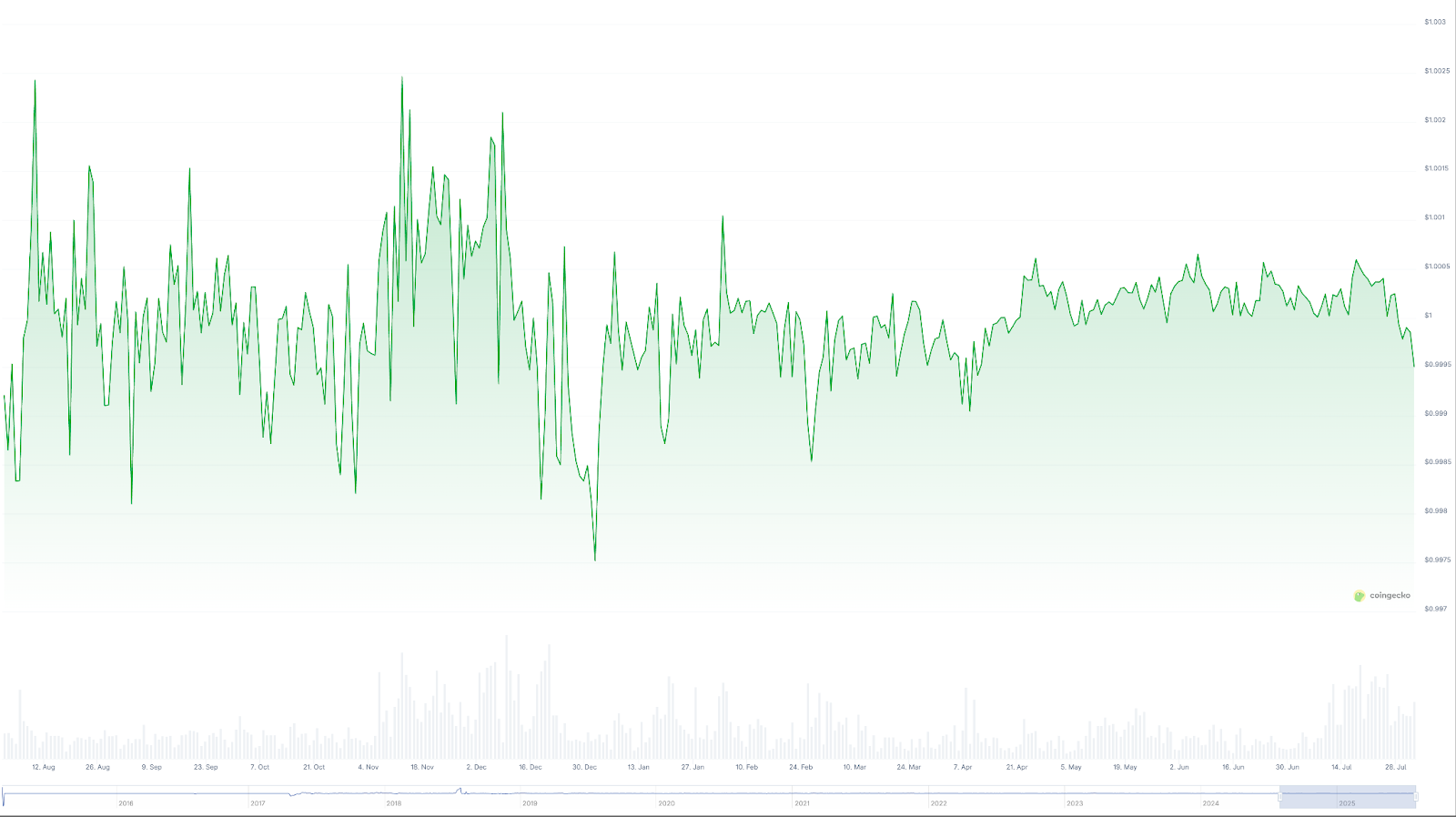

Based on that, one might ask how the $1 per unit value is maintained over time? After all, these are not FDIC insured bank deposits, nor are they rule 2a-7 regulated money market funds. It’s a very good question, and frankly there is nothing that inherently forces a stablecoin to trade at $1. However, the mechanics of the create/redeem process are no different from a money market fund or bank deposit. So while slight near-term dislocations can certainly happen, equilibrium at par will win out in the long run. As an example, below is a one-year chart of Tether (USDT).

With a $164 billion market cap, and over $116 billion in 24-hour trading volume as of August 1, 2025, USDT is an incredibly efficient and liquid instrument.

In an effort to simplify the use case and mechanics, here’s how a series of transactions across the lifecycle of USDT may take place:

- Entity A deposits $1 million dollars with Tether and receives 1 million USDT tokens to their Ethereum wallet.

- Tether uses the $1M it just received to purchase $1M worth of short duration US Treasury bills. As USDT is not interest bearing, the yield of the treasury bills is Tether’s revenue. (This is a net-interest margin business that pays 0% and lends to the most credit-worthy borrower on the planet).

- Entity A is interested in purchasing ETH on an exchange (i.e. Coinbase). Happy with the ETH quoted price (already in USD terms), Entity A uses Coinbase to swap 1M USDT tokens for $1M worth of ETH tokens (irrespective of any transaction fees).

- Entity B is long ETH but needs an additional $1M US dollars in its bank account (i.e. JPM) to meet upcoming obligations. Entity B also uses Coinbase to swap $1M worth of ETH tokens for 1M USDT tokens.

- Entity B works with Tether to redeem the 1M USDT tokens for $1M US dollars into its JPM account. Tether meets these obligations through the regular operations of its balance sheet management.

While the above example focused on stablecoins as a means for trading, the 24/7 permissionless nature of blockchain rails offer more far-reaching global benefits. No longer must one be at the mercy of banking hours, or wire transfers, or SWIFT to send dollars. Stablecoins allow for US dollars to be quickly and inexpensively transferred to anyone in the world, at any time and without the intervention of a third party. This is an extremely powerful dynamic. One that is especially true in parts of the world that have difficulty accessing the stability of US dollars, whether due to geopolitical instability or a lack of banking infrastructure.

Stablecoins: The Trojan Horse of Global Dollar Dominance

While this all sounds great, and the use cases are certainly clear for the types of people used in the previous examples, it may remain unclear why the US Government is all of a sudden behind the growth of stablecoins. One might reasonably assume that a digital dollar directly issued by the Treasury would be more advantageous. And while a true digital dollar may help to solve similar problems, it fails in comparison to stablecoins in an area of maximum importance to the United States: funding our debt.

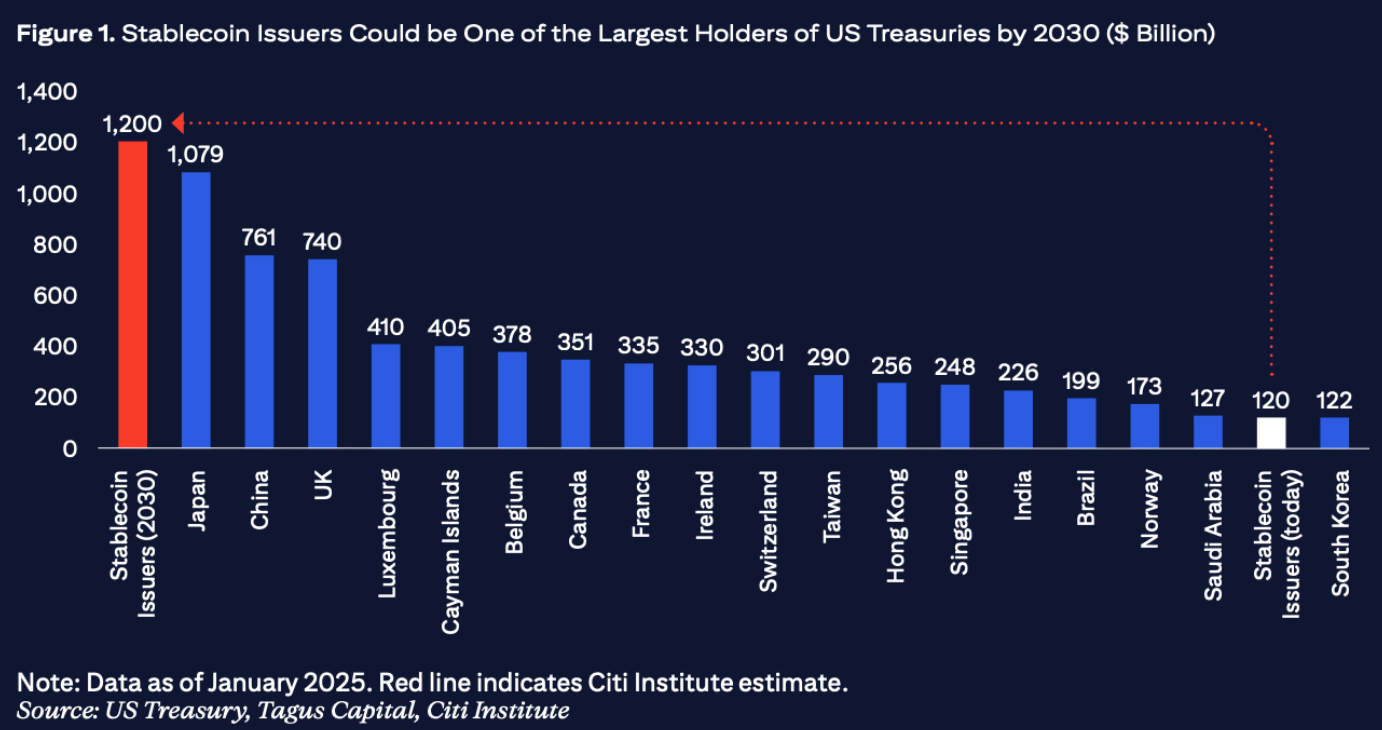

Look no further than Tether’s independently audited reserve report as of June 30, 2025. Tether is not the US Treasury. It can’t simply just print more USDT and maintain its $1/USDT value. It needs to be backed by assets, and those assets need to always be worth a dollar. As a result, Tether owns over $105 billion worth of Treasury bills. This puts Tether on par with the ownership level of nations such as South Korea, Mexico and Germany, though still a ways off from our largest lender, Japan ($1.05 T of Treasury ownership). That said, based on the projected growth of stablecoins, a recent US Treasury Advisory Council presentation projected that Stablecoin issues could hold $1.2 T of Treasuries by 2030.

Think about that. The advent of stablecoins has already created incremental demand for US Treasuries on par with major nations, and in the next five years that incremental demand could be the single largest purchaser of US debt in the world.

Price is positively correlated with demand. Bond math 101, price goes up & yield comes down. In short, stablecoins allow the US to not only continue funding its deficit, but to do so cheaper. That is simply not something that a Treasury-issued digital dollar can offer, which is why stablecoins like USDT and Circle’s USDC are the dominant use-case propelling the future of crypto.

Disclaimer

The information herein is for general information purposes only and does not, and is not intended to, constitute investment advice and should not be used in the evaluation of any investment decision. Such information should not be relied upon for accounting, legal, tax, business, investment, or other relevant advice. You should consult your own advisers, including your own counsel, for accounting, legal, tax, business, investment, or other relevant advice, including with respect to anything discussed herein.

This post reflects the current opinions of the author(s) and is not made on behalf of Hack VC or its affiliates, including any funds managed by Hack VC, and does not necessarily reflect the opinions of Hack VC, its affiliates, including its general partner affiliates, or any other individuals associated with Hack VC. Certain information contained herein has been obtained from published sources and/or prepared by third parties and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, neither Hack VC, its affiliates, including its general partner affiliates, or any other individuals associated with Hack VC are making representations as to their accuracy or completeness, and they should not be relied on as such or be the basis for an accounting, legal, tax, business, investment, or other decision. The information herein does not purport to be complete and is subject to change and Hack VC does not have any obligation to update such information or make any notification if such information becomes inaccurate.

Past performance is not necessarily indicative of future results. Any forward-looking statements made herein are based on certain assumptions and analyses made by the author(s) in light of their experience and perception of historical trends, current conditions, and expected future developments, as well as other factors they believe are appropriate under the circumstances. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict.